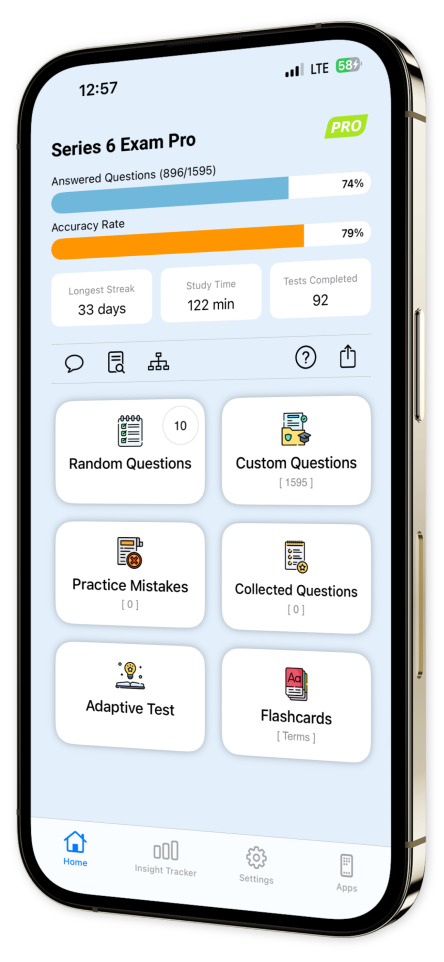

Series 6 Exam Pro iOS and Android App

Unlock Your Financial Potential with Series 6 Exam Pro!

Are you ready to excel in the FINRA Series 6 Investment Company Products/Variable Contracts Representative Exam and advance your career in the securities industry? Series 6 Exam Pro is your premier study companion, expertly designed for financial professionals aiming to deepen their product knowledge and master regulatory standards. Whether you're preparing to become a licensed mutual fund distributor, expand your credentials, or elevate your expertise in financial services, our comprehensive app equips you with the essential tools to achieve success.

Why Choose Series 6 Exam Pro?

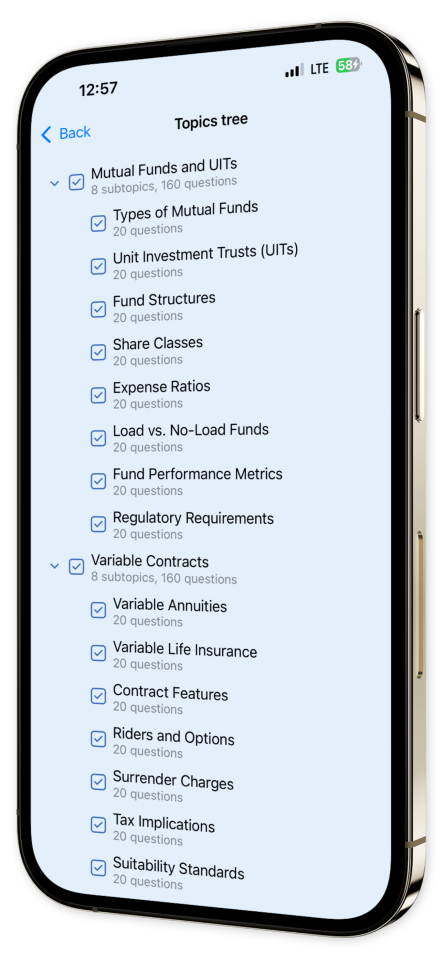

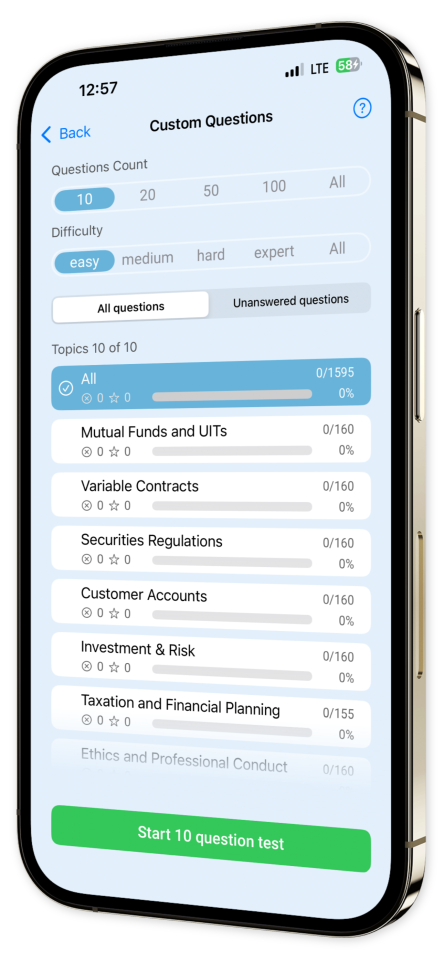

Comprehensive Content Coverage: Immerse yourself in meticulously organized content across 10 critical areas, including Mutual Funds and UITs, Variable Contracts, Securities Regulations, Customer Accounts, Investment & Risk, Taxation and Financial Planning, Ethics and Professional Conduct, Client Communication and Sales, Retirement Plans and Insurance, and Economic Factors. Each section is subdivided into focused subtopics to ensure thorough understanding and mastery of essential concepts.

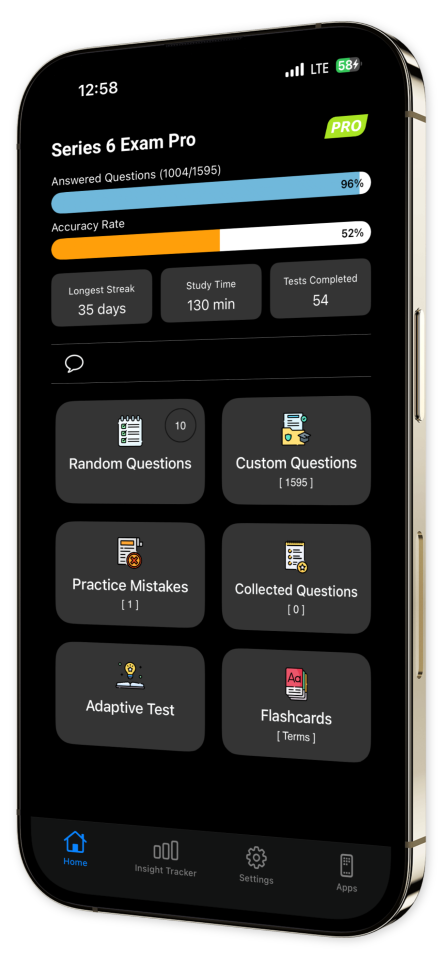

Extensive Practice Question Bank: Access a vast repository of practice questions that replicate the structure and complexity of the actual Series 6 exam. Our questions are crafted to challenge your knowledge and application of key financial products, regulatory requirements, and investment strategies.

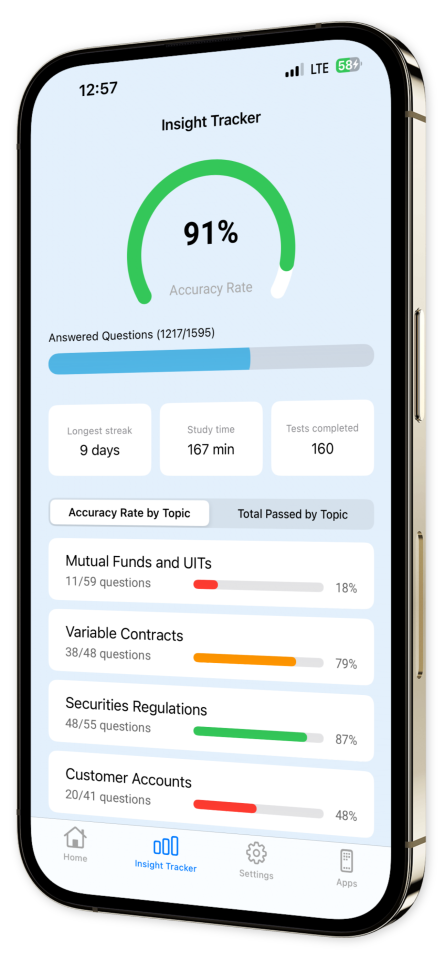

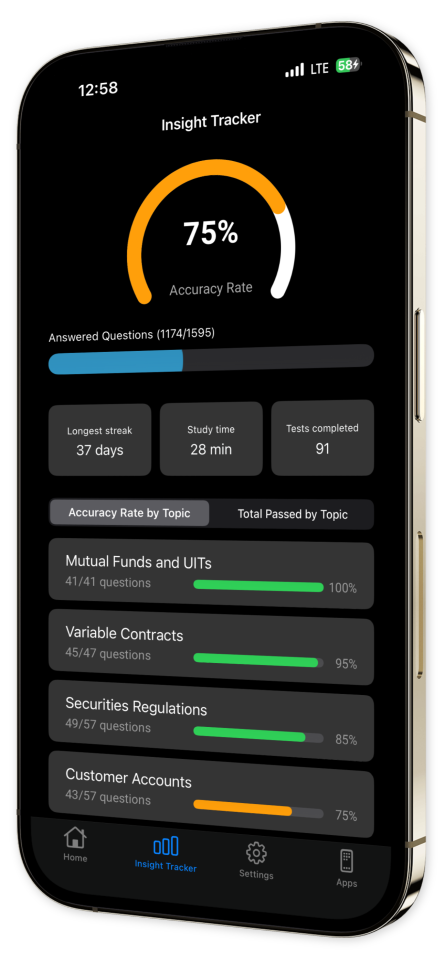

Advanced Progress Analytics: Monitor your study progress with detailed analytics that track your performance across various topics. Identify your strengths and pinpoint areas needing improvement to optimize your study efforts and ensure comprehensive exam readiness.

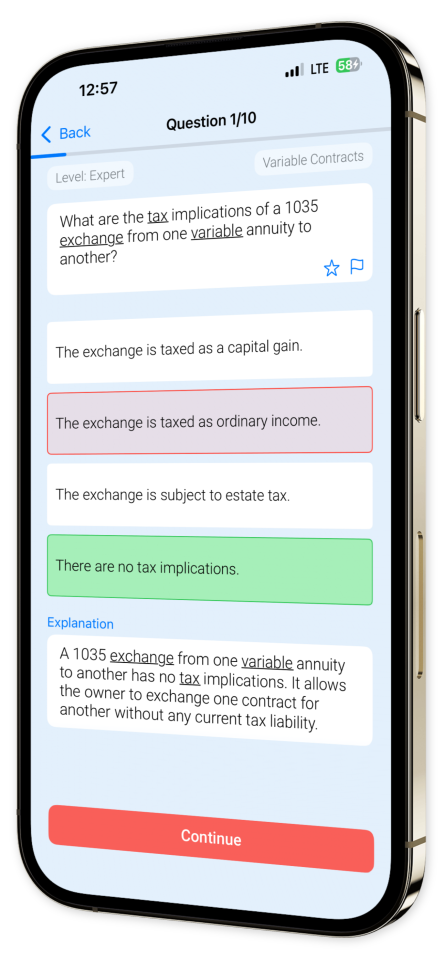

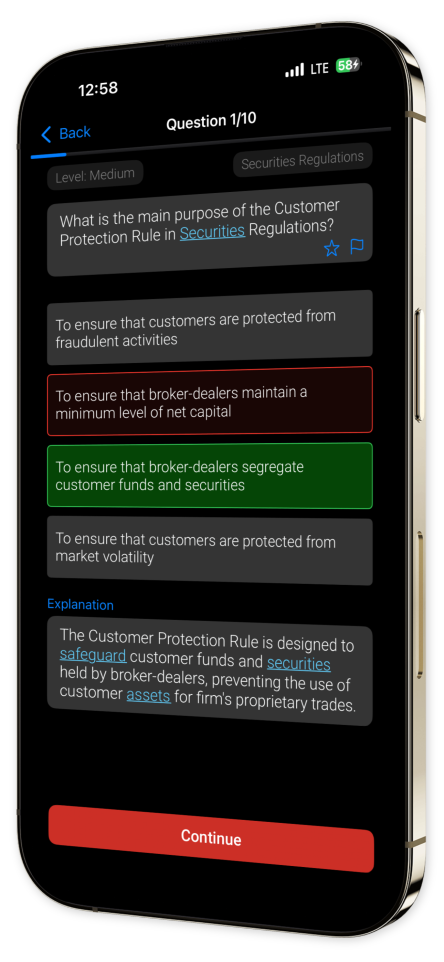

Expert Explanations and Insights: Gain deeper insights with detailed explanations for each question, providing clarity on complex financial concepts and regulatory guidelines. Enhance your understanding and retention of critical information necessary for exam success and professional excellence.

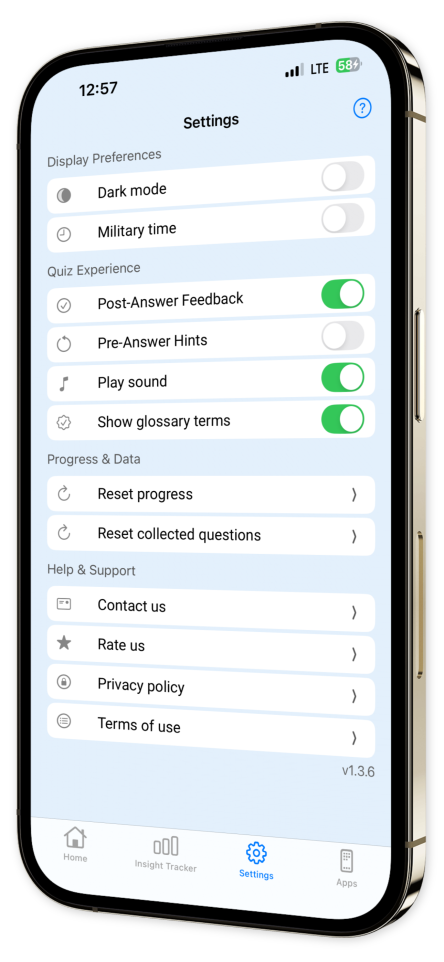

Customizable Study Plans: Tailor your learning experience with personalized study plans that align with your schedule and learning preferences. Focus on specific topics or follow a structured path to ensure balanced coverage of all exam areas.

Regular Content Updates: Stay current with the latest industry trends, regulatory changes, and exam updates. Our content is continuously refreshed to reflect the evolving landscape of the financial services sector, ensuring your knowledge remains relevant and up-to-date.

Key Features:

10 In-Depth Topics: Cover all essential areas required for the Series 6 exam, ensuring comprehensive preparation.

7-8 Focused Subtopics Each: Delve into specific aspects of each main topic for a detailed and organized learning experience.

Variety of Question Types: Engage with multiple-choice, scenario-based, and case study questions to test different levels of understanding.

Detailed Answer Explanations: Enhance your learning with thorough explanations that clarify complex concepts and regulatory requirements.

Progress Analytics: Visualize your advancement with metrics and charts that highlight your performance and growth.

Customizable Study Plans: Create personalized schedules to fit your unique study needs and professional commitments.

Offline Access: Study anytime, anywhere with full access to your materials and practice questions, even without an internet connection.

User-Friendly Interface: Navigate effortlessly through a sleek, intuitive design that makes studying efficient and effective.

Who Is It For?

Aspiring Financial Representatives: Build a solid foundation and prepare for entry-level roles in mutual fund distribution and variable contracts.

Certified Professionals: Enhance your existing knowledge and prepare for advanced certifications to boost your career prospects.

Finance Enthusiasts: Expand your expertise and stay competitive in the dynamic field of financial services.

Join Thousands of Successful Financial Professionals!

Empower your career with Series 6 Exam Pro. Whether you're aiming to pass the Series 6 exam, advance in your current role, or transition into a specialized financial position, our app provides the comprehensive resources and expert guidance you need to succeed.

Download Series 6 Exam Pro today and take the decisive step towards mastering the Series 6 exam and unlocking limitless career opportunities in the financial industry!

Elevate your financial expertise. Ace your Series 6 exam. Advance your career. With Series 6 Exam Pro, your path to professional excellence is clear and achievable.

Content Overview

Explore a variety of topics covered in the app.

Example questions

Let's look at some sample questions

What type of mutual fund share class typically has the highest expense ratio?

Class AClass BClass CClass D

Class C shares typically have the highest annual expense ratios. These costs are deducted from the fund's assets, reducing the return to investors.

What is a variable annuity?

A type of insurance contract that provides fixed payments at regular intervalsA type of investment that provides a fixed rate of returnA type of insurance contract that allows for the accumulation of capital on a tax-deferred basisA type of investment that guarantees a minimum rate of return

A variable annuity is a type of insurance contract that allows for the accumulation of capital on a tax-deferred basis. The payments received from a variable annuity fluctuate based on the performance of the investment options chosen.

What is the primary risk associated with variable annuities?

The risk that the issuer will go bankruptThe risk that the owner will outlive their incomeThe risk of losing money due to poor investment performanceThe risk that the owner will die during the surrender period

The primary risk associated with variable annuities is that the owner might lose money due to poor investment performance. Because the value of a variable annuity is tied to the performance of its underlying investments, it can decrease in value.

What type of investment option would be least suitable for an investor seeking capital preservation?

Treasury billsCertificate of depositMunicipal bondsEmerging market stocks

Emerging market stocks are typically more volatile and risky, making them less suitable for an investor seeking capital preservation.

What action should be taken if a customer's address changes?

Close the accountExecute tradesUpdate the customer's informationSend a welcome package

If a customer's address changes, the brokerage should update the customer's information. This is important for ensuring that all communication and legal documents reach the customer at their correct address.

Which of the following investment objectives is most closely associated with preserving capital?

SpeculationGrowthIncomeSafety

The safety investment objective is most closely associated with preserving capital. This objective prioritizes maintaining the initial investment and mitigating risk over achieving high returns.

How does diversification help to manage risk in an investment portfolio?

By ensuring all investments perform well at the same timeBy increasing the potential for higher returnsBy spreading investments across various asset classes to reduce the impact of any one investment's poor performanceBy concentrating investments in one high-performing asset class

Diversification manages risk by spreading investments across various asset classes. This reduces the impact of any single investment's poor performance on the overall portfolio.

Which of the following is NOT considered a violation of the Code of Conduct in Series 6?

Misrepresentation of professional qualificationsDisclosure of confidential client information without consentTaking a client's order promptlyEngaging in deceitful or fraudulent business practices

Taking a client's order promptly is part of the professional responsibility and is not a violation of the Code of Conduct.

Which action would be considered a breach of fiduciary duty?

Investing in a low-risk fund that aligns with a client's risk toleranceRecommending an investment that the fiduciary also personally invests inChurning a client's account to generate more commissionActing on a client's instructions to buy a specific stock

Churning a client's account to generate more commission is a breach of fiduciary duty. This practice involves excessive buying and selling of securities in a client's account primarily to generate commissions that benefit the advisor.

What is the most common measure of inflation in the United States?

Consumer Price Index (CPI)Gross Domestic Product (GDP)Unemployment RateFederal Funds Rate

The Consumer Price Index (CPI) is the most commonly used measure of inflation in the United States. It measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.